Home Construction Loan Process United Bank of Michigan

Table of Content

They might be more flexible in their underwriting if you can show that you’re a good risk, or, at the very least, have a connection they can refer you to. Talk to your contractor and discuss the timeline of building the home and if other factors could slow down the job. Keep in mind there are still bottlenecks plaguing production, which first started with pandemic supply-chain disruptions and still persist. Be prepared for material prices to stay high, especially in light of inflation, and ongoing shortages to affect your project.

This is different from a mortgage, and it’s considered specialty financing. Once the home is built, the prospective occupant must apply for a mortgage to pay for the completed home. While we don’t finance construction loans, we can help you when it comes time to convert this to a permanent mortgage. According to the schedule that was put together by your lender and builder, funds will be disbursed to you throughout the building process. Every lender has their own process when it comes to disbursing funds. Some lenders require an inspection during every phase of disbursements while other lenders strictly offer disbursements at the beginning, middle, and end of the process.

Home Loan - How to apply?

Whether you are buying or building a home, the first step is to get pre-qualified. This process will outline expectations on your monthly housing obligation, cash to close requirements, and the overall process. We’ll start with a review of your credit history and debt-to-income ratio.

We also offer calculators to determine home affordability, home equity, monthly mortgage payments and the benefit of refinancing. No matter where you are in the home buying and financing process, Rocket Mortgage has the articles and resources you can rely on. The contractor only receives payment for the work performed, and the borrower only pays interest on what’s paid out. You do save money if construction costs come in below the original amount of the loan, but you’ll have to find some other source of funds for that flat screen.

Service Guides

It does not account for the interior designing and only works included in the approved plan will be carried out. Weather events, supply chain disruptions, and labor shortages can cause substantial delays in construction. In addition, fluctuations in interest rates should also be considered before you begin a second home construction loan application. Once you submit your application along with supporting documents, the bank takes around 2-3 days to verify your documents. Post verification, the bank will conduct legal and technical checks on your property before finally drafting your loan agreement. At this stage, the bank decides whether to approve your home loan or not.

If you have your eye on a newly constructed home or a home that’s nearly complete, contact us today about a home loan for newly constructed homes. The chart below shows 10yr Treasury yields losing nearly as much as they'd gained after last week's inflation report. On any other week of the year, it would be unfathomable to see foreign central bank policy affect rates in the US as much as a hotly anticipated CPI report.

The United Bank Difference

The complete amount is not granted to the owner or builder right away, but instead the money is distributed in portions throughout the construction process. These portions are referred to as “draws.” Each draw will be given to the builder once a percentage of the project is completed. For example, the first draw might be given once your contractor completes the foundation. As mentioned, because they aren’t secured by a completed house, construction loans tend to have higher interest rates. You may need a higher credit score to get a construction loan than to get most mortgage loans. Private lenders and regional banks are often best for construction loans.

With a construction loan, as with all other loans, you must pay interest on the money you borrow. Typically, construction loans are variable rate loans, and the rate is set at a “spread” to the prime rate. Essentially, this means that the interest rate is equal to prime plus a certain amount.

Once your credit is determined to be acceptable, the lender will require income documentation, verification of your employment, and proof of your liquid assets. These items will be verified and analyzed to determine the amount of loan you qualify to receive. Regardless of the type of a construction loan, closing costs can range from 2% to 5% of the home’s value. Not much different from the closing costs on a stand-alone mortgage, they include fees for credit checks and other loan underwriting procedures, title insurance and transfer and recording fees, among others. Depending on the homeowner’s contract with the builder, the latter may offer some modest assistance with paying the closing costs.

Unlike mortgages that pay out a lump sum so that the borrower can execute the purchase of an existing residence, construction loans are made of draws or disbursements of funds for each stage of building. In most instances, the builder — and not the borrower — receives money directly from the lender when it is time to, say, lay the foundation, complete the roof or install plumbing. During the so-called draw period, the borrower is only required to make interest payments and only on the money already released. A construction loan is a short-term loan that covers only the costs of custom home building.

You may receive from time to time, announcement about offers with intent to promote this Website and/or facilities/products of ABC Companies (“Promotional Offers”). The Promotional Offer would always be governed by these Terms of Use plus certain additional terms and conditions, if any prescribed. The said additional terms and conditions, if prescribed, would be specific to the corresponding Promotional Offer only and shall prevail over these Terms of Use, to the extent they may be in conflict with these Terms of Use.

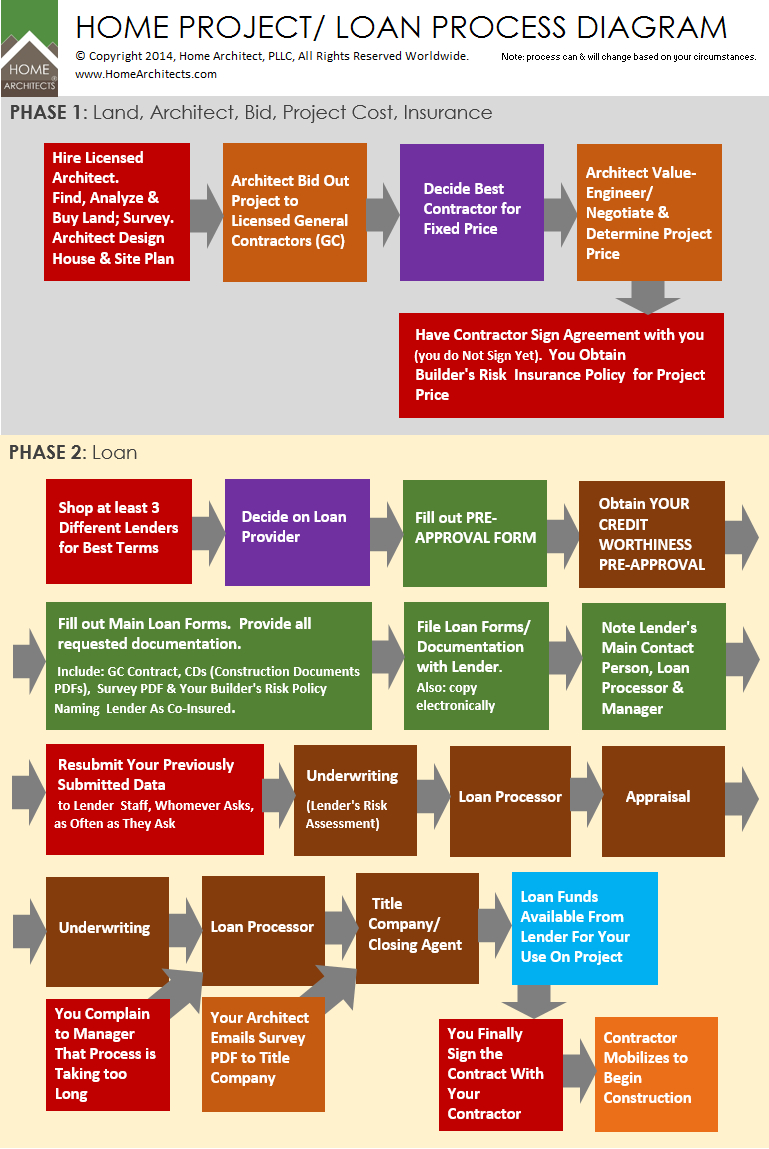

Financing new home construction is more detailed than any other type of loan. Banks are less willing to hand out these loans to just any borrower because they hold such an element of risk. If you do not have an adequate credit history or have any other factors that make your loan profile seem risky, you will likely not be able to obtain the loan. If you are among the lucky that are able to secure this type of loan, here is the process that you will undergo.

Homebuilding often takes longer and costs more than initial projections indicate. The information contained herein is generic in nature and is meant for educational purposes only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product.

Komentar

Posting Komentar